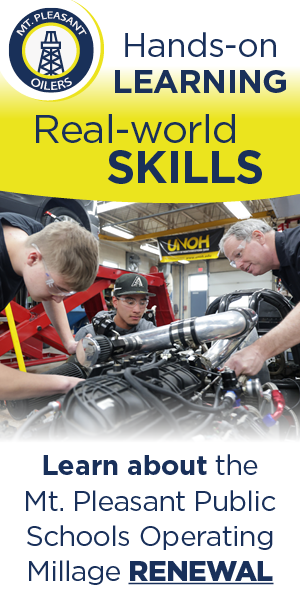

The Mt. Pleasant Public Schools Operating Millage Renewal - May 6, 2025

This is a renewal proposal that is not paid by homeowners and DOES NOT cost homeowners one penny in taxes.

This renewal is paid by rental property owners, owners of second homes, commercial properties, and businesses, and simply renews and continues what has been in place for at least the past 20 years.

Mt. Pleasant Public Schools is recognized as being among the top K-12 public school districts in Michigan and across the country, with Oilers consistently scoring higher on state testing and graduating at higher rates than the statewide average.

Mt. Pleasant Public Schools has a proven track record of fiscal responsibility, transparency and accountability, and if passed, all funds from this renewal will be subject to an annual independent audit and be publicly disclosed on the district’s website.

What a YES vote means:

A YES vote would allow Mt Pleasant Public Schools to levy the required mills and have 0.6263 mills to protect against future reductions.

A YES vote would continue to keep Mt Pleasant Public Schools at the allowable operating millage for ten more years.

A YES vote is NOT a tax on your primary residence. Homesteads (primary homes/residences) are exempt from this millage.

What a NO vote means:

A NO vote would reduce state funding Mt Pleasant Public Schools receives.

A NO vote means Mt Pleasant Public Schools could lose more than $10 million in state funding each year for the next 10 years